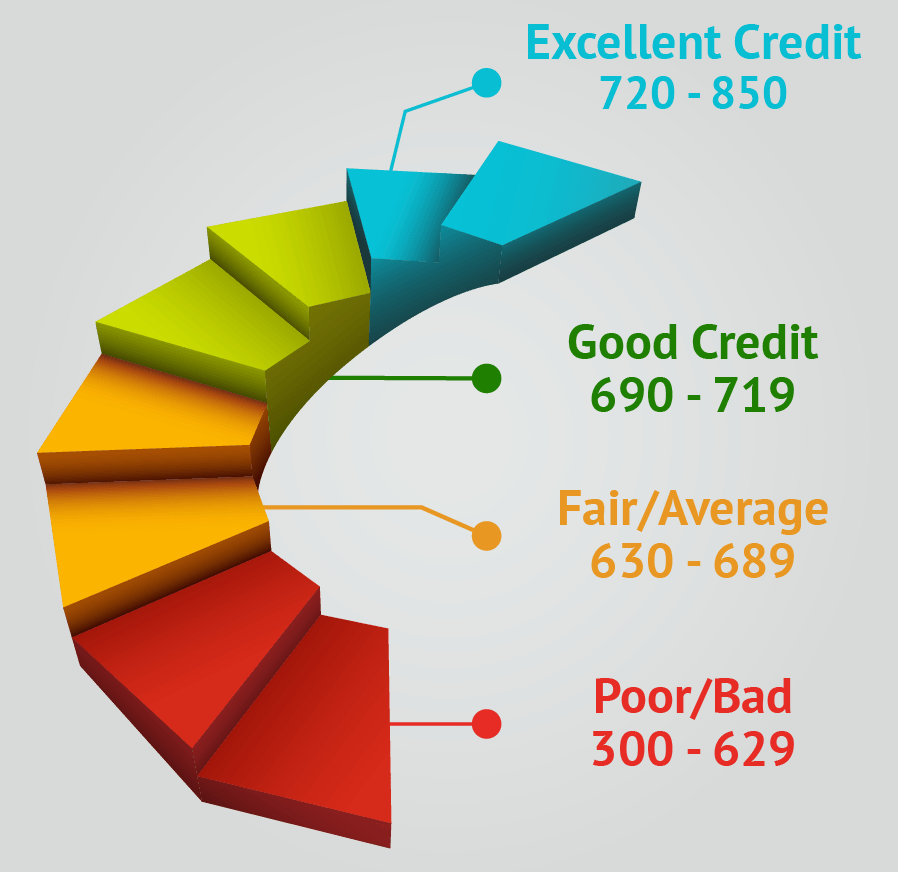

Higher credit scores mean you have demonstrated responsible credit behavior in the past, which may make potential lenders and creditors more confident when evaluating a request for credit. It's important to remember that everyone's financial and credit situation is different, and there's no "magic number" that may guarantee better loan rates and terms.Īlthough ranges vary depending on the credit scoring model, generally credit scores from 580 to 669 are considered fair 670 to 739 are considered good 740 to 799 are considered very good and 800 and up are considered excellent. It’s one factor among many to help them determine how likely you are to pay back money they lend. Credit scores are used by potential lenders and creditors, such as banks, credit card companies or car dealerships, as one factor when deciding whether to offer you credit, like a loan or credit card. There are many different scoring models, and some use other data in calculating credit scores. Credit scores are calculated using information in your credit report, including your payment history the amount of debt you have and the length of your credit history. Generally speaking, a credit score is a three-digit number ranging from 300 to 850.

It’s an age-old question we receive, and to answer it requires that we start with the basics: What is a credit score, anyway? Credit scores are calculated using information in your credit reportsĬredit scores generally range from 300 to 850ĭifferent lenders have different criteria when it comes to granting credit

0 kommentar(er)

0 kommentar(er)